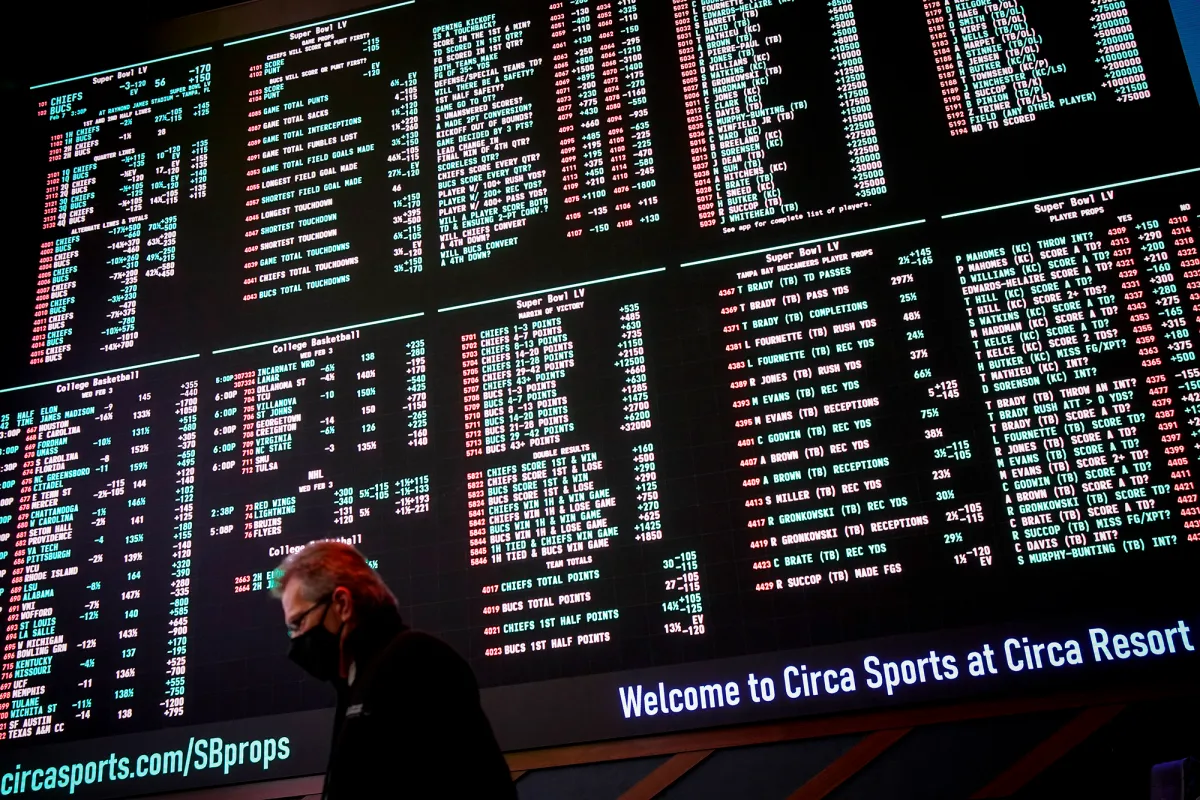

New York keeps setting the bar for the sports betting as the betting capital of the world continues to break its own records. However, the nine operators that are accepting wagers daily have expressed their concerns as the tax rate is at 51 percent, which is tied for the largest in the country.

What Will Be the Outcome of the High Tax Rate

Although sportsbook giants like FanDuel and DraftKings continue to shatter records, one problem is clear for these bookmakers. These operators will take at least three to five years to be profitable.

Many successful companies have overcome tough times to become profitable and sustainable. However, DraftKings’ stock has also plummeted as the stock is down over 60 percent in its year-to-date portfolio. Despite the concerns that continue to be expressed, there may not be some sort of breakthrough in the next legislative session.

Assemb. Gary Pretlow stated on a news source that the tax rate is likely to stay the same. In the last session, Pretlow introduced legislation that would have reduced the tax rate by increasing the number of operators. However, that bid was unsuccessful as this was noted to be too quick of a transition as the launch just took place.

These sportsbooks are affected by more than just the high tax rate. It costs a lot of money to create ads, market the company, and gain new customers. The state also prohibits these bookmakers from using any kind of promotional deductions, as it’s a luxury in some other jurisdictions across the nation. At the end of the day, these companies can’t just go all-in on just one state.

New York Continues to Break Records as States Like California and Texas Wait in the Shadows

During the period from January 8th to December 18th, the online sports betting operators handled $15.5 billion in handle, yielding $1.3 billion in gross gaming revenue and a US record $660.4 million in tax revenue, thus breaking all the projections of $615 million posted less than a year ago. In addition, the state has a couple more weeks until it reaches its fiscal year ending date.

The question regarding this whole case is why can’t the state just add more operators? For example, neighboring New Jersey has a low barrier to entry, which means numerous brands have set up shop in the state, as some companies originated from Europe.

The answer is set in stone, as 98 percent of the revenue goes towards funding programs like education and youth sports. Adding more competitors means that the tax rate is likely to go down, and the costs to receive a license will follow. Even with more competitors, these programs could end up with fewer funds, which would be a major concern for the school boards across the Empire State.

What are the Other Options That Could Be Discussed?

Assemb. Gary Pretlow has other ideas that could help these sportsbooks in the long run, which is expanding the range of what people can bet on. According to Pretlow, he plans to introduce legislation in the upcoming legislative session to allow bets on individual player award futures, such as MVP, Coach of the Year, and Cy Young awards.

Currently, NY bettors cannot bet on award futures requiring a vote, which is what bettors in New Jersey can do. These types of awards have high odds, which could attract many bettors.

In most cases, there could only be one winner as the amount of money only grows in the preseason, during the season, and even hours before the results are finalized. The losses will outweigh the wins as the House will most likely cash in every time.